Article originally published in Carat Singapore's Mediascape April 2015 edition.

A 4-year partnership of co-shared content between Mediacorp and Microsoft in Singapore came to an end and a new beginning for the Singapore digital landscape commences on 1st April this year. xinMSN is now rebranded as the global brand MSN, and Mediacorp has taken their catch-up TV asset Toggle, along with their xinMSN editorial team, onto a new eponymous domain called Toggle.

Toggle is now being branded as a lifestyle and entertainment portal hosting Buzz articles from both the local entertainment scene to Hollywood. Nonetheless, Toggle’s key selling point still leverages on video sourced from Mediacorp’s original free to air content, as evidenced by the positioning of their TV materials on the top of the homepage. As compared to the previous Toggle hosted on xinMSN, the new Toggle requires no login to watch from channels such as Channel 5 and Channel U. However, logins will still be required to access exclusive content on Toggle-It-First. So, how would Mediacorp’s “online video” offering fare?

To compare, we should look to Youtube itself, for the online video space in Singapore is dominated by this global powerhouse. Youtube reaches 56% (2,299,000 Unique Visitors) of the total internet audience in Singapore and the page views on Youtube amounts to almost 376 million per month according to Comscore. No other global online video brand has this kind of reach in Singapore as both Tudou and Dailymotion have a reach of 10% of the internet audience. Youtube is also the top site in terms of dwell times, followed closely by Facebook.

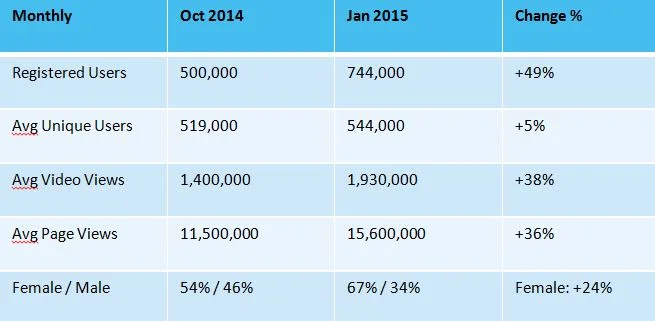

Comparatively, since its inception in 2013, Toggle has amassed 744,000 registered users as of Jan 2015, but if we compare this data with Oct 2014, there has been some encouraging growth in the numbers according to the media owner’s data:

The 49% jump of registered users in a span of 3 months bodes well for Toggle, especially since Toggle is only entering its 2nd year anniversary. The target audience profile has also skewed further towards a female audience (67%) in this 2 month gap. This jump in registrations and the female skew could be due to the Toggle-It-First functionality that was introduced in the latter half of 2014, which features content that has yet to air on offline TV channels on Toggle first. This functionality provides the incentive for CH 8 TV drama fans – who are probably revving to find out what has happened to their favourite characters in the latest story arc – to join Toggle. Though there is a subscription rate of $9.90/month for the Toggle-It-First premium function, the registration numbers are expected to still rise in the new few months, as we project that Mediacorp will continue to employ various marketing strategies to promote Toggle more aggressively after the xinMSN split announcement.

Additionally, another business strategy that could help boost Toggle’s numbers is if they look where their traffic is coming from: which is on mobile (76%). This % is similar to Youtube’s mobile visitorship, whereby mobile video views comprises of 70-75% of the available Youtube inventory. Based on this user behavior, it seems that mobile is probably Toggle’s best potential point for expansion.

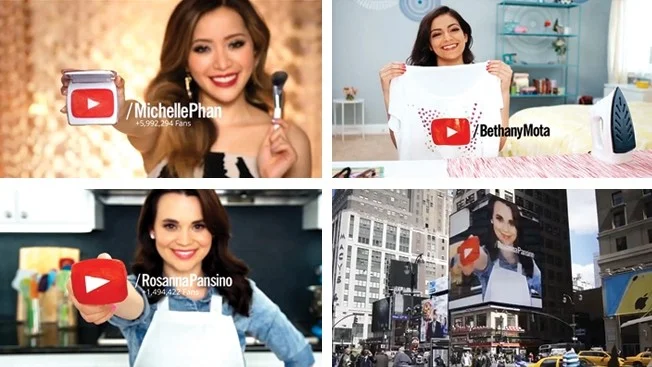

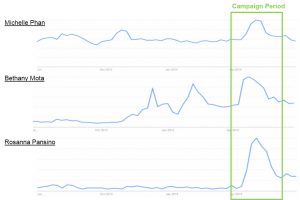

Another point of expansion for Toggle would be on content. To compare again with Youtube, Youtube has 300 hours’ worth of videos that are uploaded every minute globally (Source: Google), with most of them accessible to those based in Singapore. This means that the possibilities of exploring content are endless on Youtube. We have seen Youtube changing the traditional TV production house model by giving regular joes a chance to create and broadcast their messages online. Local favorites Wah Banana, Night Owl Cinematics & Tree Potatoes have all leveraged on this opportunity and Google is acutely aware of the influence these content producers. As such, Google has developed globally driven programs to further (1) nurture their existing and upcoming talents by providing training of Youtube best practices and (2) connect potential advertisers with relevant Youtube talents. Both programs are in their initial roll out phases in Singapore.

The nature of Toggle’s content – though culturally relevant to the Singapore experience – has limitations as it is largely sourced from existing TV programming based on the linear idea of TV programming. In other words, the content is finite in contrast with Youtube, where the content is incredibly varied and versatile due to its content generation model that is largely user generated. Another question to consider by Mediacorp executives: do the topics covered by offline TV viewing fit within an online context?

Mediacorp realizes this and is now creating material that will solely be screened on Toggle. Their first Toggle Original venture called “Sabo” will be featured from Apr 6 -17 with an angle that is akin to Ashton Kutcher’s Punk’d show on MTV. The pranked are none other than Mediacorp’s own artistes. These 10 min episodes will be released daily and there will be 12 in total. Though the format is short and digestible as befitting the attention span of an online audience, the subject matter recycles the “Just For Laughs”or “Punk’d” TV format that had worked on TV for many years. It is also telling that the episodes contain Mediacorp artistes that have built their successful careers on offline channels. It will be interesting to watch how both media corporations and artists pivot to the online space.

It is too early yet to tell how this new Toggle will fare and only time will tell – but the future looks promising for Singapore’s own online video channel, if managed right.